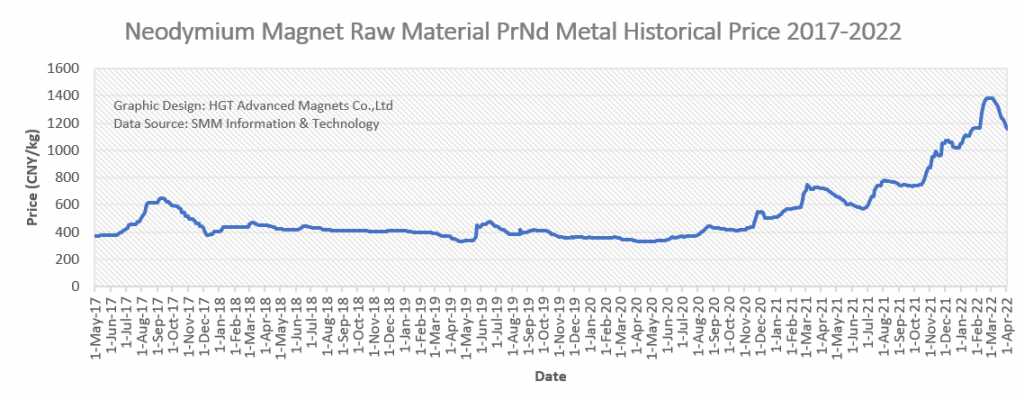

Rare earth PrNd metal price trend is the vane of neodymium magnet price trend

Neodymium magnets contain rare earth elements, iron, boron and other elements. The rare earth elements in the magnets account for 28-35% by weight. As rare earth raw material prices are much higher than those of other raw materials, their cost accounts for 80-98% of the total raw material cost. Especially affected by the rising market of rare earth raw materials since 2021, as of the time of writing this article (April 6, 2022), their cost has accounted for about 95% or more.

The cost of rare earth raw materials significantly affects the neodymium magnet price. The regularly used rare earth raw material is PrNd metal, Dy and Tb elements are used for some high temperature applications (typically 150-200°C). In this article, the raw material PrNd metal price trend 2022 was discussed.

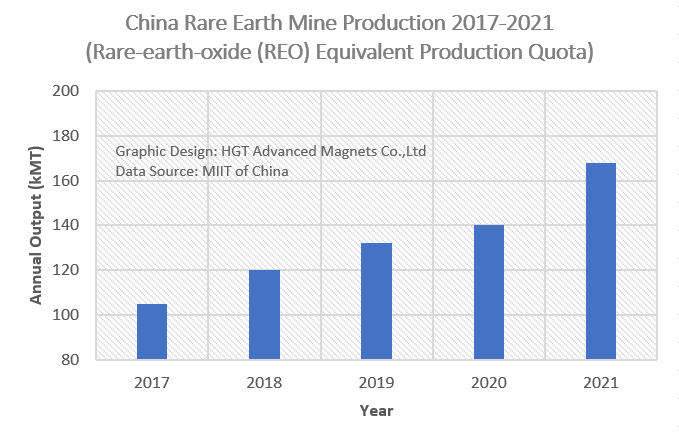

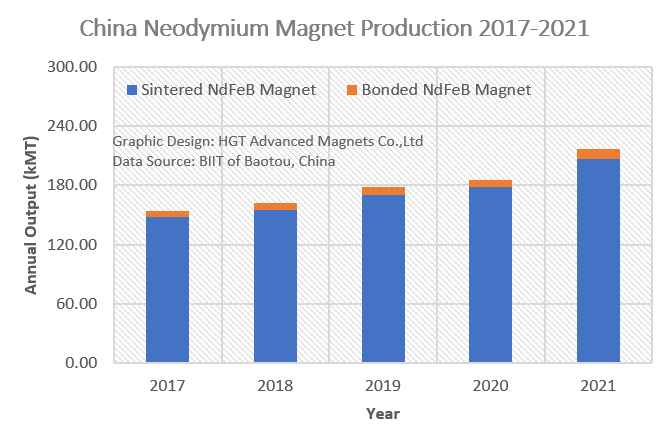

China rare earth raw materials supply and China neodymium magnet production

China rare earth mine (rare-earth-oxide, REO equivalent) production in 2017 is 105,000 metric tons, it is 168,000 metric tons in 2021. China rare earths’ compound annual growth rate (CAGR) between 2017 and 2021 is 9.86%. During the same period, China neodymium magnet production in 2017 is 154,290 metric tons, it needs to consume about 55,800 metric tons of REO equivalent. It is 216,480 metric tons in 2021, it needs to consume about 78,200 metric tons of REO equivalent. China neodymium magnets’ CAGR between 2017-2021 is 7.01%. It can be seen, China rare earths’ CAGR is 2.85% higher than that of China neodymium magnets. China neodymium magnets consumed more than 50% of China rare earths in 2017, and by 2021 their consumption had dropped to less than 50%.

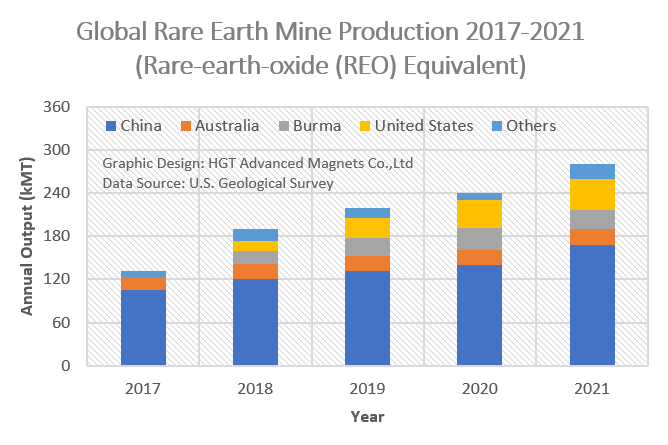

Global rare earth supply chain

China supplied more than 95% of the global rare earths in the 2010s. China’s global share dropped to around 80% in 2017. By 2021, China’s global share had further dropped to around 60%. During 2017-2021, China’s CAGR is 9.86%, while the global CAGR is 16.23%. It can be seen, rare earth production outside China had grown much faster than China’s. As the world pays more attention to the security of rare earth supply chain, rare earth mining projects outside China will continue to maintain high growth in the next 3-5 years.

Rare earth PrNd metal price trend 2022

Overall, global rare earth supply growth is significantly higher than neodymium magnet consumption growth. In addition, the supply channels of rare earths are becoming more diverse and stable.

Rare earth prices have plunged sharply since March after hitting their highest in nearly a decade in February. Typically, PrNd metal price continued to drop by around 16% in March. Following this trend, it is predicted that PrNd metal price will drop to below 800,000 or even 600,000 CNY per metric ton in 2022.